EU Carbon Market In Steep Decline After Years Of Selling All Sizzle and Little Steak

This week the EU parliament declined to continue to prop up the ailing EU Carbon Market. The market which was originally conceived with the best of Kyoto and Climate Change intentions, had turned into a feeding frenzy in the financial derivatives industry, much like the wild west US mortgage derivatives market that collapsed in 2008. The carbon market money to be made, and boy oh boy was there ever money to be made in commissions on hundreds of billions, was in churning the market by trading, repackaging, trading, and on and on that the brokers and managers of the market reveled in.

The idea that in a Kyoto world where a mere 15% of greenhouse gas emissions reductions was the target, somehow resulted in a market that reached highs of well over €100 billion year after year was a mystery. Well not really a mystery after we learned through the collapse of the US mortgage market a few years back that markets don’t need to be based on real product, but can be based on derivative paper designed to confound and confuse.

In the EU carbon market how does €10 Euro per tonne carbon turn into €100+ billion per year market dealing in the trading of the 15% of 8 billion tonnes of CO2 reduction targeted by the Kyoto Accord. Hmmm 15% of 8 = 1.2 billion tonnes CO2 X €10 ought to equal about €12 billion, but wait, it became €120 billion or more. Where there are fees and commissions to be made the sky is clearly the limit, to hell with clearing the sky.

OK OK so there were some details we are glossing over but the reality was/is that the EU carbon market has been a traders and brokers wonderland that eventually had to catch up with vast amounts of the wonder being siphoned out of the market into brokerage and trader profit accounts. Follow the money.

So this week when the EU Parliament declined to NOT prop up the market, the price for carbon dropped 45% to around €3 or less. At this price it will leave the carbon brokers, siblings, and profiteering vultures of climate change in the lurch. Only a very few greenhouse gas reduction offsets, carbon credits, can survive at this price.

So this week when the EU Parliament declined to NOT prop up the market, the price for carbon dropped 45% to around €3 or less. At this price it will leave the carbon brokers, siblings, and profiteering vultures of climate change in the lurch. Only a very few greenhouse gas reduction offsets, carbon credits, can survive at this price.

What parts of carbon trading might survive or rather what should survive.

First and foremost of what might survive are of course the vast volumes of economic downturn “carbon offsets” being pushed into the market. These windfalls to countries whose old and decrepit heavy industry ceased operation, not by any intent to provide climate change solutions, but more because after the collapse of the Berlin wall there was no subsidized support keeping them in business. Yes the people who had jobs there have suffered greatly but to use climate change funds to provide a social safety net at the expense of the environmental safety net is surely not the right thing to do.

Enter avoided deforestation, REDD, a second chance for the carbon brokers and traders to move paper and for green wealth redistribution advocates who survive on selling a good donation pitch. In this case all one has to do is hold forests hostage and make the claim that if a those holding the forest hostage are not paid that the forest hostages, one hostage tree at a time will be mercilessly killed and thrown onto the street to prove the hostage takers sincerity in demanding payment. This can provide pretty low priced product to package and paper and keep the market going a little longer. It provides immense opportunity for NGO’s to send out email fund raising pitch letters to their fatithful.

Where does this leave the alternative energy developers. Wind and solar folks have long been arguing that the price of carbon emission reduction that alternative green energy would make their industries surge if only the price were to rise to €50 or more. Even when carbon prices were more than €25 the carbon value of wind and solar to the project engineering cost was never more than 10%-15%, neither a deal maker or deal breaker for alternative energy. But it was a hell of a broker and trader paper packaging opportunity where selling the “sizzle” was way more productive than selling the “steak”.

There are some geoengineers of vast atmospheric CO2 cleaning machines and Globe sized shades but that’s a story of its own… read here….

What’s left that can make true large volume low cost greenhouse gas reductions? And we desperately need large volume low cost solutions that are real and not market sizzle hype.

We can plant and restore trees, this isn’t a way to make one rich but it can provide jobs to people who need one. Not great paying jobs, but the bottom end jobs at the low end of societies pay scale. Trees as they grow take CO2 out of the air and turn it into the tree itself, the trunk, the branches, the twig, the leaves.

But as trees grow very slowly and start out life being tiny the carbon they eventually capture and turn into homes for birds, bugs, and shelter for everything in their forest just don’t make carbon financial sense if the CO2 is accounted for in real time.

All the money to plant a carbon forest has to be spent in the first few years and almost none of the carbon is captured then. Only if one does the carbon forest accounting over a long period of forest growth time, say 35 years in the tropics and 50 years in temperate zones does the carbon make economic sense. Even with a long term project finance and payback schedule like what is commonly used to build large commercial buildings, ex ante project finance, intentionally planting a carbon forest to make a lot of money makes very little economic sense.

If however one is prepared to to the right thing and adopt the guiding principal of “save the world, make a little money on the side” one can figure a way, with like minded people helping to plant trees to help grow our way out of our CO2 crisis. But is is work for wages, and most certainly not broker and trader wages!

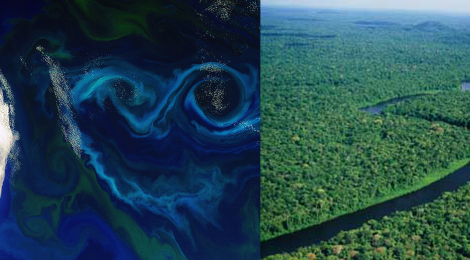

We can also restore the seas. This involves replenishing and restoring vital mineral micronutrients that have stopped blowing in the wind and nourishing ocean plankton blooms. The collapse of ocean plant life is a terrible feedback on high and rising CO2 in the atmosphere.

As the earth observing world has measured in each five year period we are losing the amount of CO2 eating plant life in the oceans that is equivalent to cutting down an entire Amazon Rainforest. Since we started receiving data from Earth observing satellites in the early 1980’s, we’ve watched the plankton equivalent of 6 Amazon rainforests worth of trees be eradicated from our ocean pastures.

This is because of the vast increase in grass growing on land which we call “good ground cover.” That ground cover prevents dust from blowing in the wind and the dust in the wind that has gone missing has resulted in those 6 Amazon Rainforests worth of plant life disappearing from this blue planet.

So here is the good news.

The cost of replenishing and restoring ocean pasture plankton blooms is mere pennies per tonne of CO2 converted into restored ocean life itself. Imminently affordable, even profitable with a small p.

So in this collapsing European carbon market that has destroyed itself through unfettered greed and profiteering just perhaps it has created an environment where real tangible CO2 reductions in our air can take place through the restoration of Sea and Trees!